Word to the Wise: M&A Snapshot – Kiwetinohk Resources Corp. and Distinction Energy Corp.

July 6, 2021

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

M&A announcements continue to dominate the headlines in the oil and gas industry. As the premier tool for scoping and evaluating corporate and asset A&D opportunities, we are pleased to offer some high-level summaries of a recent agreement between Kiwetinohk Resources Corp. (“Kiwetinohk”) and Distinction Energy Corp. (“Distinction”).

What do the companies look like prior to completing the agreement? What do we know about each company’s assets, core areas, and recent activity? How might this combination affect others in the area? We’ve looked at both companies through a few different lenses to allow you to compare the companies and gain some insight of your own.

Click here to download a pdf report of the above data, including land and drilling history data.

Core Areas

The announcement release mentioned the strategic combination is important for two reasons: one, to be a low-cost gas producer and two, to reduce emissions associated with production and delivery of hydrocarbons. XI is releasing a new product in the coming weeks to provide companies the ability to look over the fence for emissions calculations.

There is little direct overlap in the two companies’ land positions other than that centered around 60-24W5 and given how spread-out Distinction’s assets are, it may be prudent to look for non-core properties.

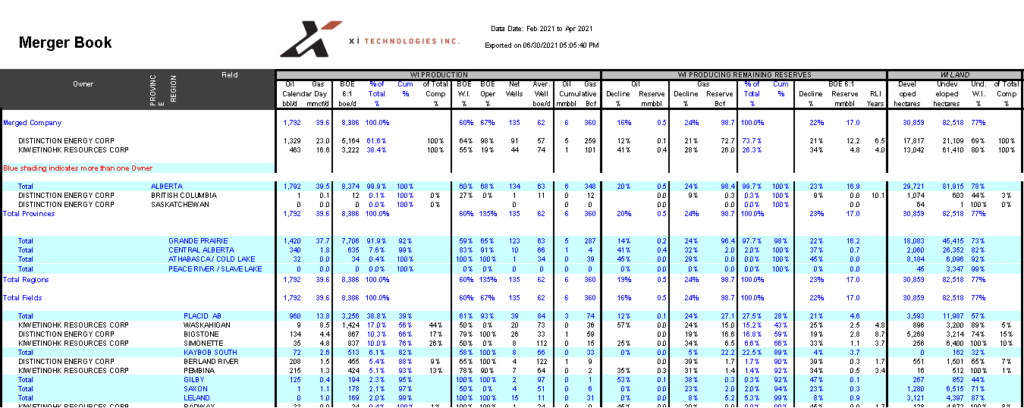

Looking at XI’s Merger Book, we can quickly see where the assets fall below a percentage that would be considered core to the company. A company in the market to pick up assets could approach the new Kiwetinohk Resources to see if they were looking to divest these assets rather than manage them outside of their true core interests.

Click here to download the Merger Book report from AssetBook.

Once high-level scoping identifies assets of interest, it’s prudent to look at the liabilities associated with them. The ARO Module of the AssetBook allows you to get a true over the fence look at any grouping of assets to assess the potential end of life liability. The result is a more efficient, targeted, and timely approach to continued M&A activities.

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, contact XI Technologies.