Word to the Wise: Montney Overview

March 2, 2021

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like Wednesday Word to the Wise delivered directly to your inbox, subscribe here.

The Montney has seen a lot of action in recent A&D activity as new players look for opportunities in this prolific play. Today, we’ll draw on XI Technologies’ enriched industry data to offer a few perspectives as to what’s happening in the Montney play.

Ownership in Montney Assets

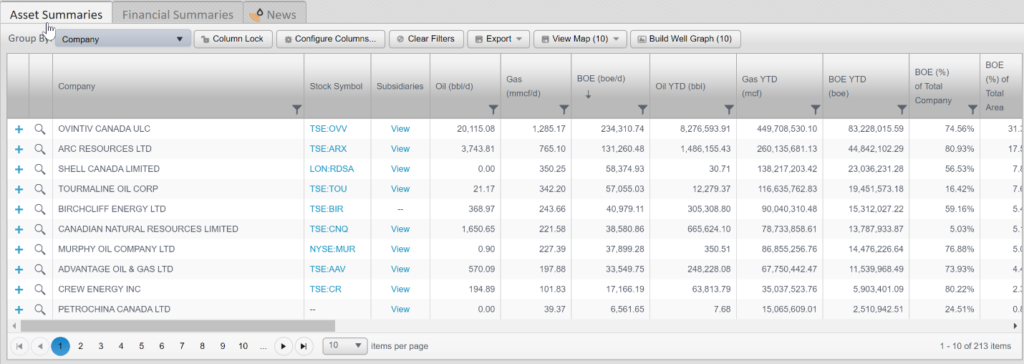

While a lot of recent A&D activity has focused in the Alberta area of Montney that is south of Grande Prairie, we thought it may be interesting to look at the prolific play around Dawson Creek that falls more in British Columbia.

Pulling a quick search of the Montney zone within the defined geographic area around Dawson Creek, we can quickly see that Ovintiv Canada ULC (Ovintiv) is the largest player. The ownership structure of this area is quite different from the ownership south of Grande Prairie with the top three here being Ovintiv, ARC Resources Ltd (ARC), and Shell Canada Limited (Shell) and the top three in Alberta being ARC (including the Seven Generations assets), Hammerhead Resources Inc., and Nuvista Energy Limited.

Click here for a spreadsheet of this data.

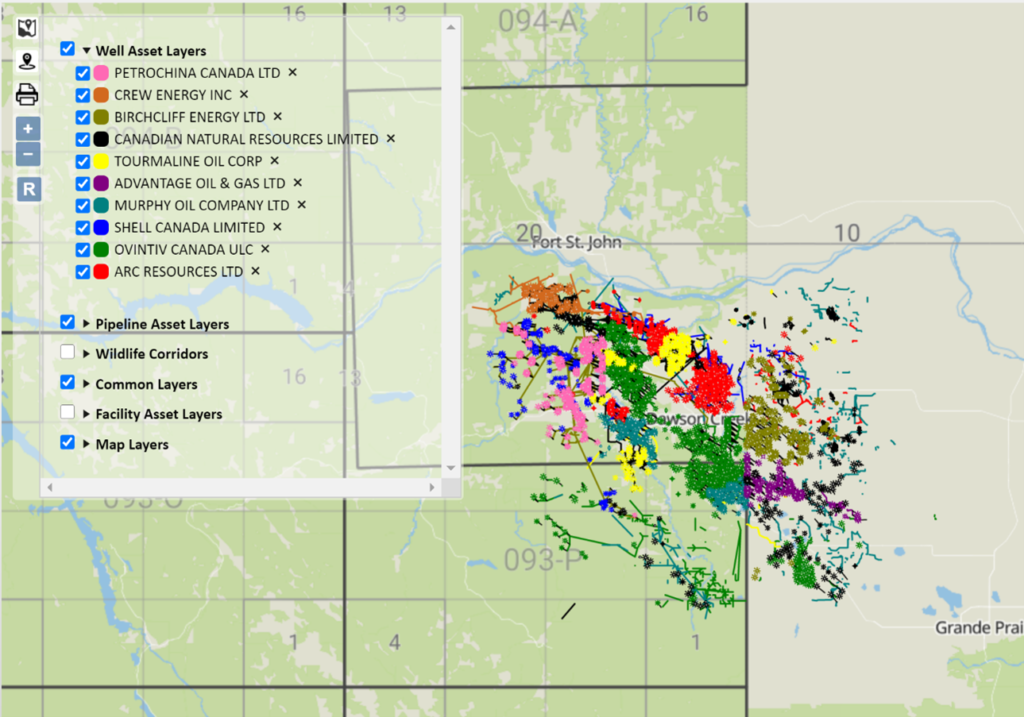

The map below shows the top 10 Montney players (based on current boe/d) in the Dawson Creek area

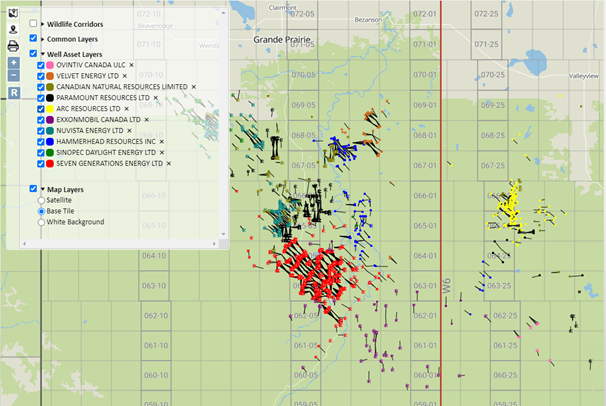

For contrast, the map below describes the area south of Grande Prairie. If you are interested in the ownership in this area, please contact XI for further details.

Production History of Montney Assets

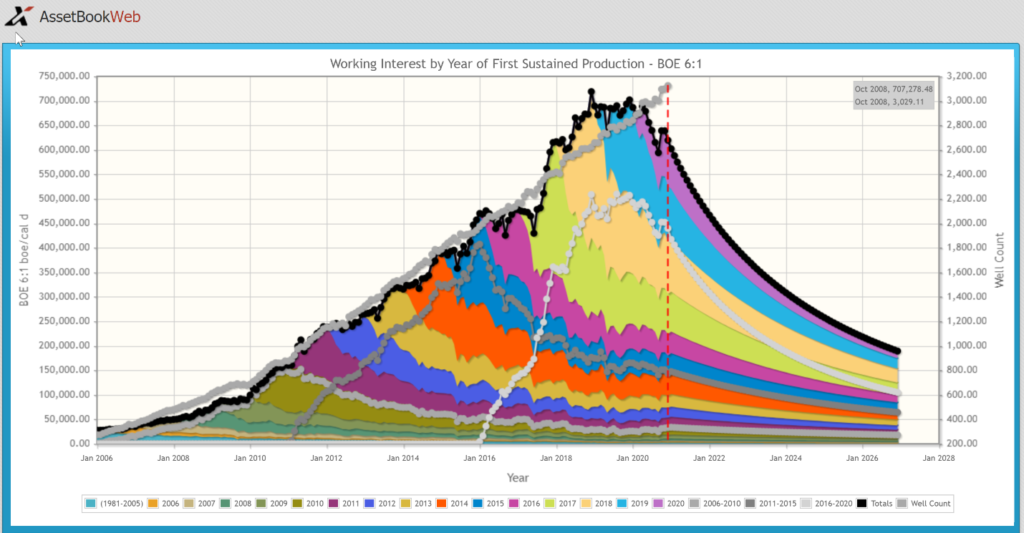

Let’s investigate the Dawson Creek Montney play a little further. Looking at the vintage of this production confirms that most activity in the Montney is relatively recent, with a good percentage of the production coming from 2017 or later.

Looking at normalized average production based on year gives a sense of the change in the productivity of the play over the years.

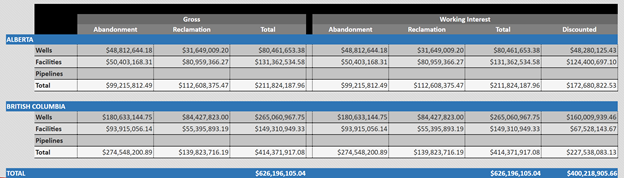

It is also important to look at liabilities between various acquisition opportunities to determine differences in future obligations. While the table below shows liabilities for the whole area, it is very simple to create a similar report for any company of interest.

In a future article we’ll explore drilling activity to get a more complete picture of the area.

If you would like to re-create these workflows, we invite you to attend an upcoming webinar. We will provide an in depth look at how to understand and evaluate an area. Register today for Take Your M&A Scoping to the Next Level on March 18 or Analyzing the Montney on March 23.

If you’d like to learn more about how XI’s AssetSuite software can analyze regions throughout Western Canada, contact XI Technologies.