Word to the Wise: 3 reasons why knowing working interest partners is essential to oil and gas asset management

August 18, 2020

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

It’s no secret that understanding working interest partnerships is a key part of oil and gas operations. But while everyone understands the key role working interest plays in a company’s balance sheet, there are elements of asset management touched by working interest partners that might not be properly incorporated into your workflow. Areas where knowing working interest partners can be the difference between seizing opportunity or courting disaster.

Here are three big reasons why knowing working interest is essential to oil and gas asset management:

1. Acquisitions and Divestitures

One of the first parts of due diligence in A&D scoping should be to investigate the potential working interest in an opportunity. Doing so will let you know:

- The most likely bidders for an asset (as current working interest partners may look to increase their share of an asset).

- If there are opportunities among assets you currently share with working interest partners, both for assets you’d like to acquire and those you’d like to divest.

- Any potential working interest partner relationships you can leverage or ones you’d like to avoid.

- Whether or not there are liability concerns with potential working interest partners, which could turn a potential asset into an unnecessary risk (see below).

2. Asset Retirement Obligations

The Redwater decision made it essential for producers to have an up-to-date, readily available assessment of their working interest partners. Should a company you share working interest with go into default, the responsibility for any closure orders on their inactive assets fall to their working interest partners. A closure order due to the sudden, unexpected insolvency of a working interest partner can blindside a producer. Liability and closure costs they hadn’t budgeted for – or didn’t even realize they were responsible for – can suddenly come due at a time when many producers have been forced to drastically cut budgets. Even worse, a closure order could be triggered by regulator records that are far out of date, and don’t accurately reflect current ownership.

At XI Technologies, we have worked with clients who discover (by using AssetBook software) that the land transfers on hundreds of working interest properties sold years prior had never been completed by the provincial regulatory body. If closure orders had been issued related to these lands, the result would have been a very unpleasant surprise that might have to be sorted out under pressure of the 60-day closure timeline.

3. Service and Supply Company Opportunities

Oilfield Service (OFS) companies can maximize their potential opportunities and realize economies of scale by examining working interest in targeted areas. This expands their reach beyond the Licensee of an asset and opens up opportunities otherwise unseen. Marketing to working interest partners can open up opportunities with more E&Ps, creating potential new relationships, and new opportunities for costs savings due to Area Based Closures.

No matter which area of operations you’re focused on — A&D, ARO, or service and supply work, knowing the working interest partners of assets is essential. The key is having access to reliable, up-to-date, and actionable data on working interest. The more difficult it is to check on the working interest of a potential opportunity or examine your current working interest partners, the less likely it is these steps will be part of your decision-making (or if they are, the more time can be wasted in your work flow).

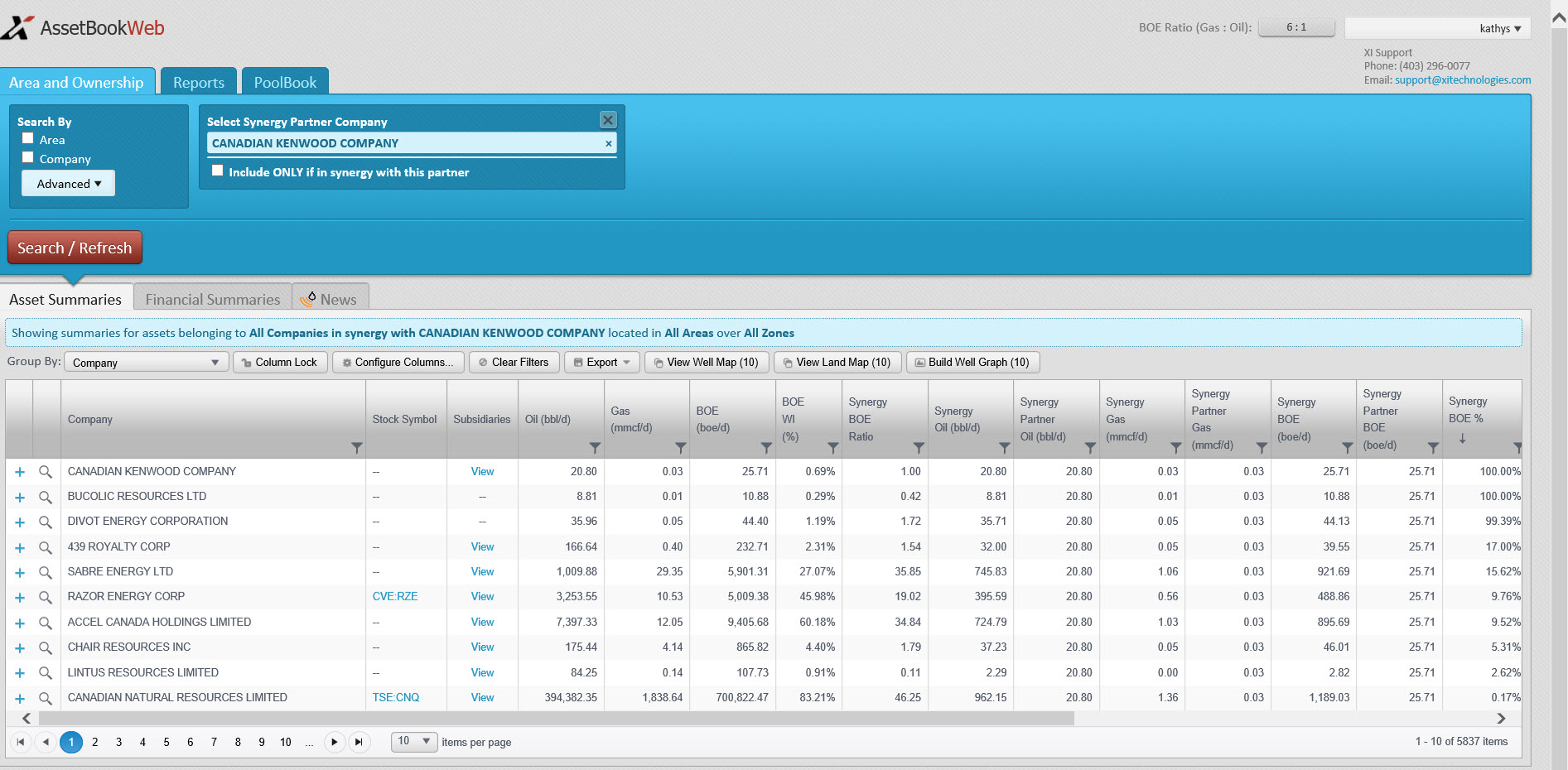

When building AssetBook, XI recognized the need to understand all parties involved in an asset portfolio and the estimated shared amounts of assets between multiple companies. A simple Synergy report can give you a target company’s working interest partnerships, weighted by shared BOE percentage, and what percentage of both partner company’s total assets the shared BOE represents.

Using tools like the Synergy Report in AssetBook can help producers have a reliable, easy way of assessing working interest partnerships. To see how you can create a Synergy Report similar to the one pictured above, watch this video. For a more in-depth look at how XI can help you stay on top of your working interest partners, contact us to book a personalized demo.