Word to the Wise: Open Asset Evaluation for July 2020

July 14, 2020

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Succeeding in oil and gas development comes down to how well and how quickly you can analyze potential opportunities. Once a month, XI Technologies will apply its evaluation tools to a currently available asset to give readers a sense of the opportunities available and how they can be evaluated for A&D purposes.

For this month, XI will examine the Land sale of NEBC Missile by PNG on behalf of Crew Energy. On July 7, 2020 Crew offered for sale a land play in BC for 10,106 gross hectares through Pngexchange.

Potential Buyers

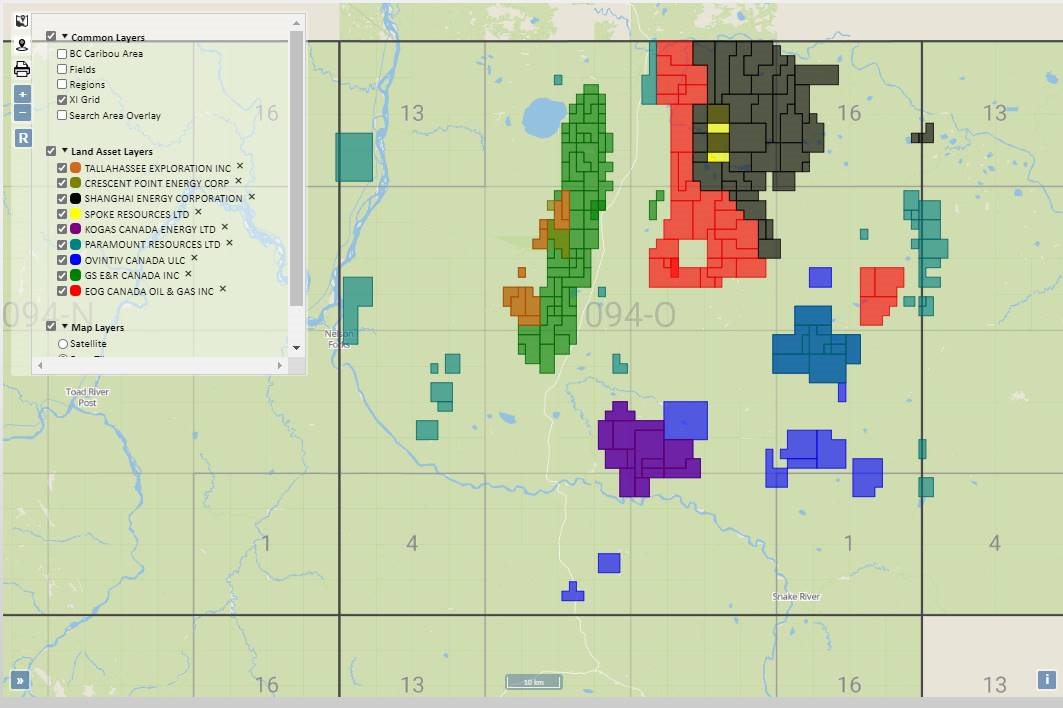

For this land asset, the best way to examine the most likely bidders for the asset is to examine which other companies already own assets in the area, as they may be looking to increase their imprint in the area to benefit from economies of scale. Here is a map of the top ten companies wells and land in this area:

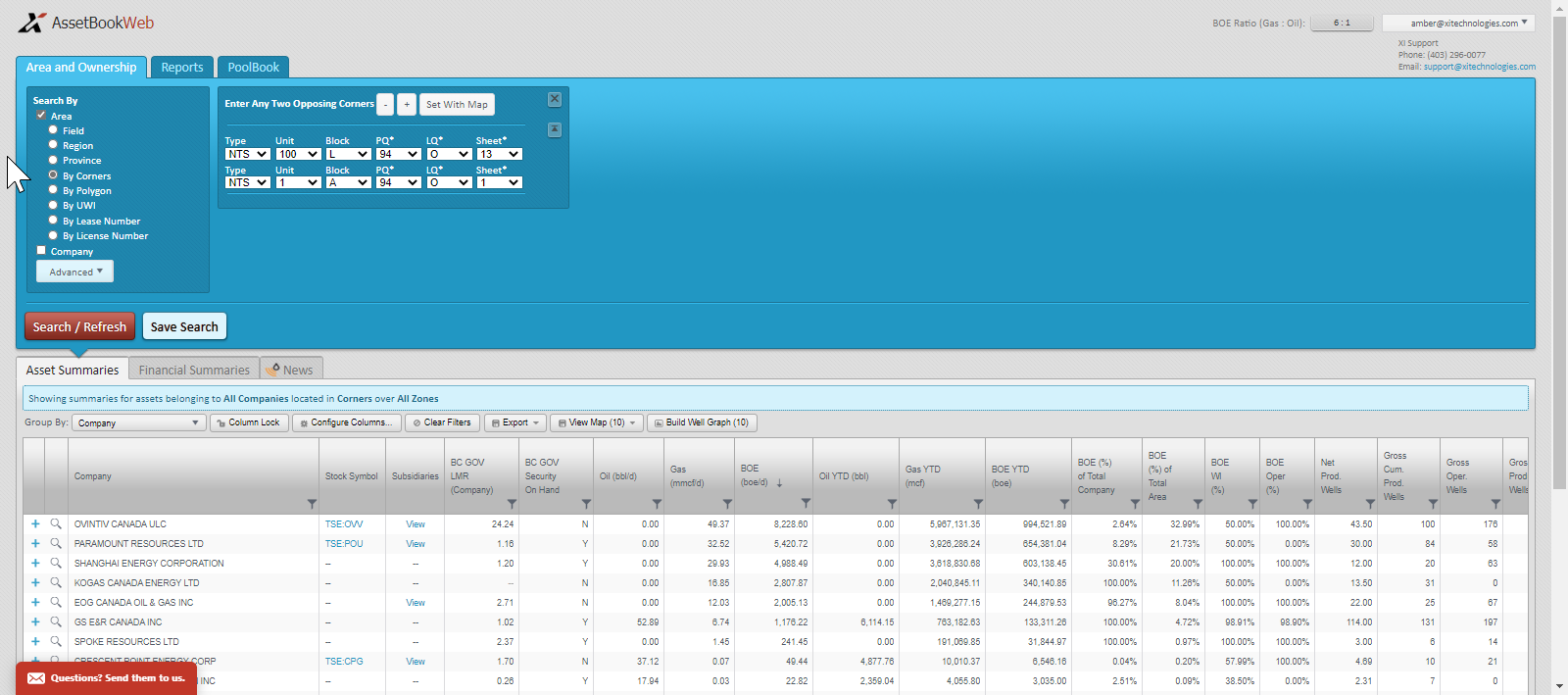

Here is an Area Report for this asset. If you would like to see more information, please contact XI:

Click here to download a full spreadsheet version of this report.

Asset Liabilities

One of the most important parts of A&D research is looking at the liabilities carried by the asset. The listing is a land offering and therefore has no liabilities tied to it, but Crew does have some liabilities in the area. As well, looking at XI’s calculated LLR report could provide information on which companies are in a better position to purchase these assets. If you would like a demo of AssetBook’s LLR module, please contact XI