Word to the Wise: Open Asset Evaluation for June 2020

June 2, 2020

Succeeding in oil and gas development comes down to how well and how quickly you can analyze potential opportunities. Once a month, XI Technologies will apply its evaluation tools to a currently available asset to give readers a sense of the opportunities available and how they can be evaluated for A&D purposes.

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

For this month, XI will examine the property sale by TimberRock Energy. On May 6, 2020 and updated May 20, 2020, TimberRock Energy posted a 100% working interest sales/farmout or other negotiated deal on 98,763 acres of land in Grande Prairie.

Potential Buyers

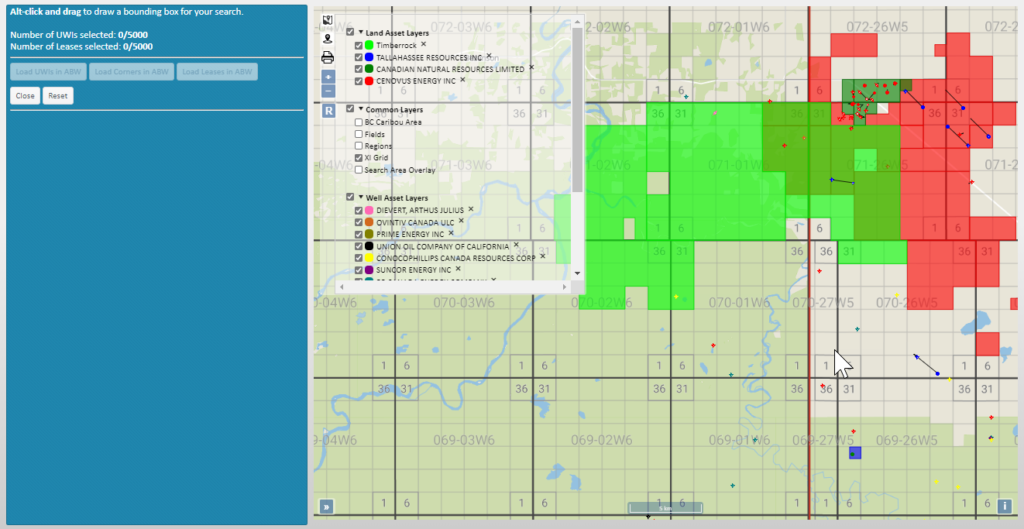

An important thing to do when evaluating a potential land acquisition is to look at who the most likely bidders for the asset would be. The first thing to check for is who has a core interest in the area by running a quick search in the AssetBook. By expanding the area, we can see there are about 74 companies with interest in this area. Here is a map of the top ten companies wells and land in this area:

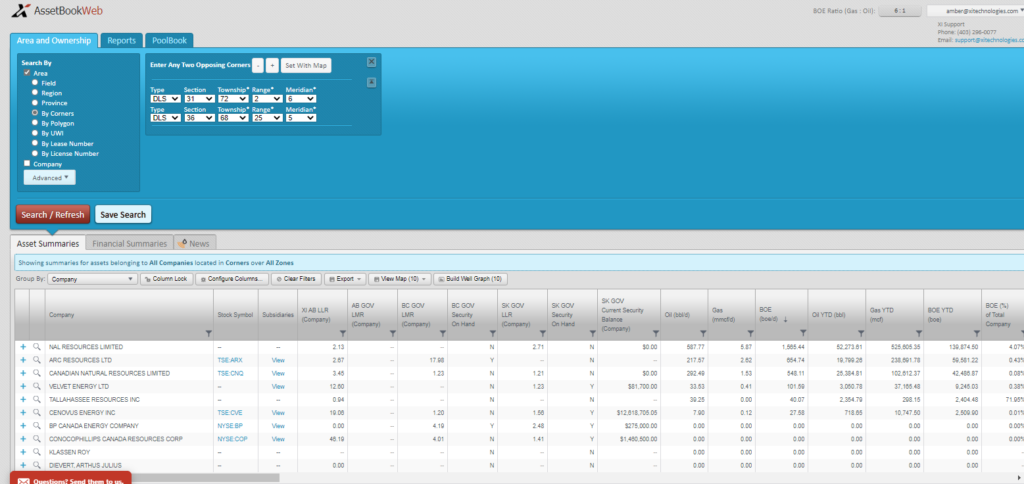

Below are the details of the companies with ownership in the area:

Click here to download a full spreadsheet version of this report.

Asset Liabilities

One of the most important parts of A&D research is to look at the liabilities carried by the asset. The listing has only land, but looking at XI’s calculated LLR report, all companies in the area are in a good position for a purchase, as all are above the 2.0 required by the government to transfer these assets. If you would like a demo of AssetBook’s LLR module, please contact XI.

These are just a few quick ways to do A&D prospecting, using a real-world example that is currently available for purchase. If you’d like to learn more about how XI’s AssetSuite can analyze potential acquisitions, contact XI Technologies.