Word to the Wise: Bank redeterminations now include a detailed ARO component – are you ready?

June 11, 2019

Redetermination of bank credit facilities is an annual or semi-annual exercise that almost all E&P companies have become used to.

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

While credit redeterminations can involve reviewing a range of financial information, until recently the primary focus was on reserves reports and projections – the asset side of the business that banks use as an indicator of future income and collateral. Some degree of ARO analysis began being incorporated in the review process over the past few years. The 2019 Redwater ruling established that the abandonment of a bankrupt company’s inactive wells takes precedence over the bank being paid out. Since then, the banks have been paying much closer attention to abandonment and reclamation liabilities, also called asset retirement obligations or ARO.

“Having worked in the LLR and ARO space for several years now, we deal with most of the major Canadian banks,” said Shovik Sengupta, Senior Data Solutions Specialist with XI Technologies. “A number of our bank customers, as well as our E&P clients have confirmed this shift and given us a lot of insight into the kinds of liability information that banks are looking for during the redetermination process.”

“We’ve taken that information” Sengupta continued, “and created an easy-to-generate overview report that provides banks and companies all the information they need to start the discussion over credit redeterminations. They can gather the information they need in minutes rather than days. While banks might utilize XI’s standardized cost model to arrive at a total ARO number, companies can easily add their own costs, thereby presenting a more realistic or accurate position. It makes the conversation so much clearer and more efficient.”

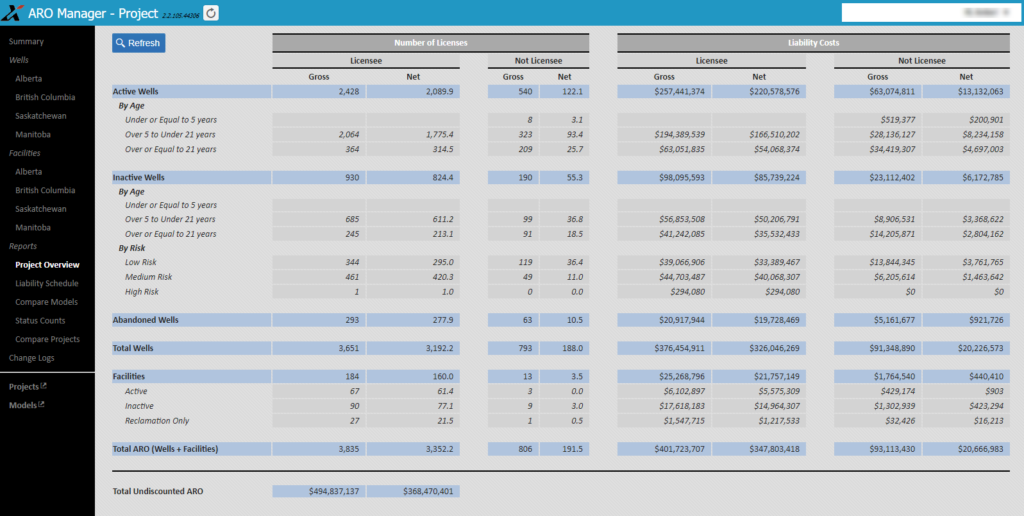

The bank-requested information provided on the XI Project Overview report includes an accurate count of active and non-active wells. These wells need to be sorted into age categories of less than or equal to 5 years of age, over 5 years but under 21 years, and then 21 years and above. Banks also want to know how many of a company’s inactive wells would be categorized as low, medium, or high risk. And finally, they also want an accurate count of a company’s active and inactive facilities, as well as those decommissioned facility sites that still require reclamation.

“In addition to the physical counts,” adds Sengupta, “banks and creditors want to understand the number of these wells and facilities where the company is the licensee versus non-licensee. And from there, they want either actual or estimated costs assigned to determine a realistic value of the ARO being carried by the company.”

XI’s AssetBook ARO Manager makes it easy for companies and banks alike to estimate, track, manage, and report asset retirement obligations across the lifecycle of every asset, then roll it up into a continuously up-to-date corporate ARO report. This increases transparency for senior management as well as for funding agencies. The ability to modify the standardized cost model – or create a custom, company-specific cost model – allows companies to reflect their own cost actuals accurately and be able to present exactly the information that their lenders are looking for.