Word to the Wise: Alberta production curtailment could have unintended negative impacts for smaller producers.

January 2, 2019

Alberta’s mandatory production curtailment includes an exemption for the first 10,000 barrels of oil produced. This measure was intended to protect some smaller producers, but will it really protect them?

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like our Wednesday Word to the Wise delivered directly to your inbox, subscribe here.

Under the terms of the curtailment order, small companies with non-operated production could be vulnerable to the shut-in requirements and decisions of their larger working interest partners. XI’s AssetBook makes it simple and quick to review risk potential for small producers, and equally simple for large producers to look for curtailment opportunities. If you would like to analyze your situation, contact XI for help.

A hypothetical example:

Let’s see how curtailment by a large producer could potentially impact smaller producers with whom they partner. We’ll use Canadian Natural Resources as our large producer. As the WCSB’s largest producer, they’re going to have to make some strategic decisions and they have a significant number of working interest partners.

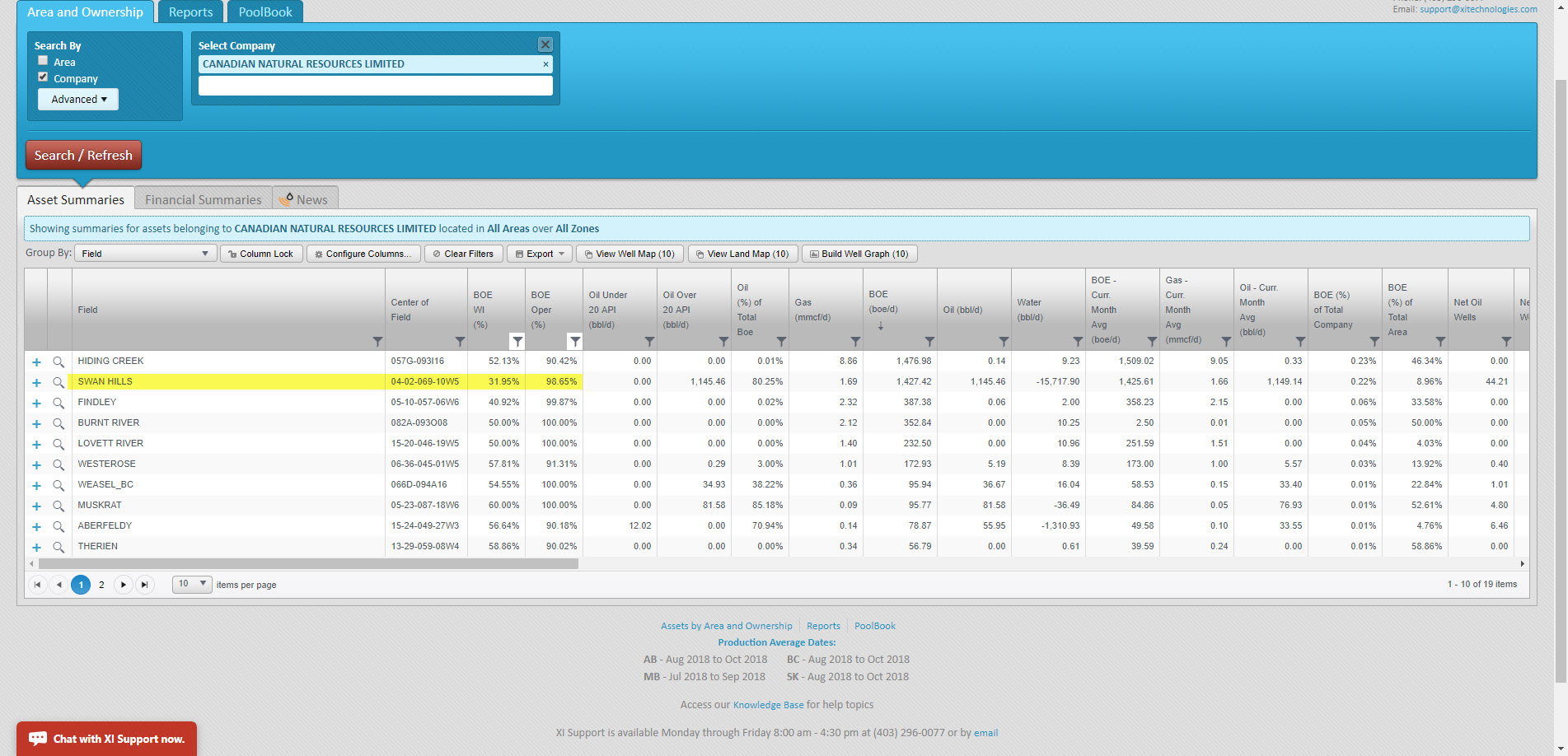

What if CNRL decided it would be most efficient to shut in operated production in non-core areas? To determine who might be vulnerable to this decision, we would need to search for potential non-core areas particularly interested in areas where CNRL operates but have a partnership with others to see who may be vulnerable. With a quick search in AssetBook, we can see there are 17 fields where CNRL has less than 60% working interest and greater than 90% operatorship. Most of them would appear to be non-core. Obviously, we don’t know for sure what CNRL might deem as non-core. There are many other factors that might influence whether these are core areas to CNRL, such as drilling activity, active facilities in the area, and general economics of the play. We’re simplifying for this example, but smaller companies can also consider a number of these other factors when using AssetBook to predict their vulnerability.

Looking at Swan Hills, CNRL has 31.95% working interest in this area. They operate the area at 98.65%, but Swan Hill makes up a small portion of their overall production. In addition, they haven’t drilled in 36 months in this area! Based on this information, it would seem like Swan Hills might be a likely candidate for an efficient shut-in.

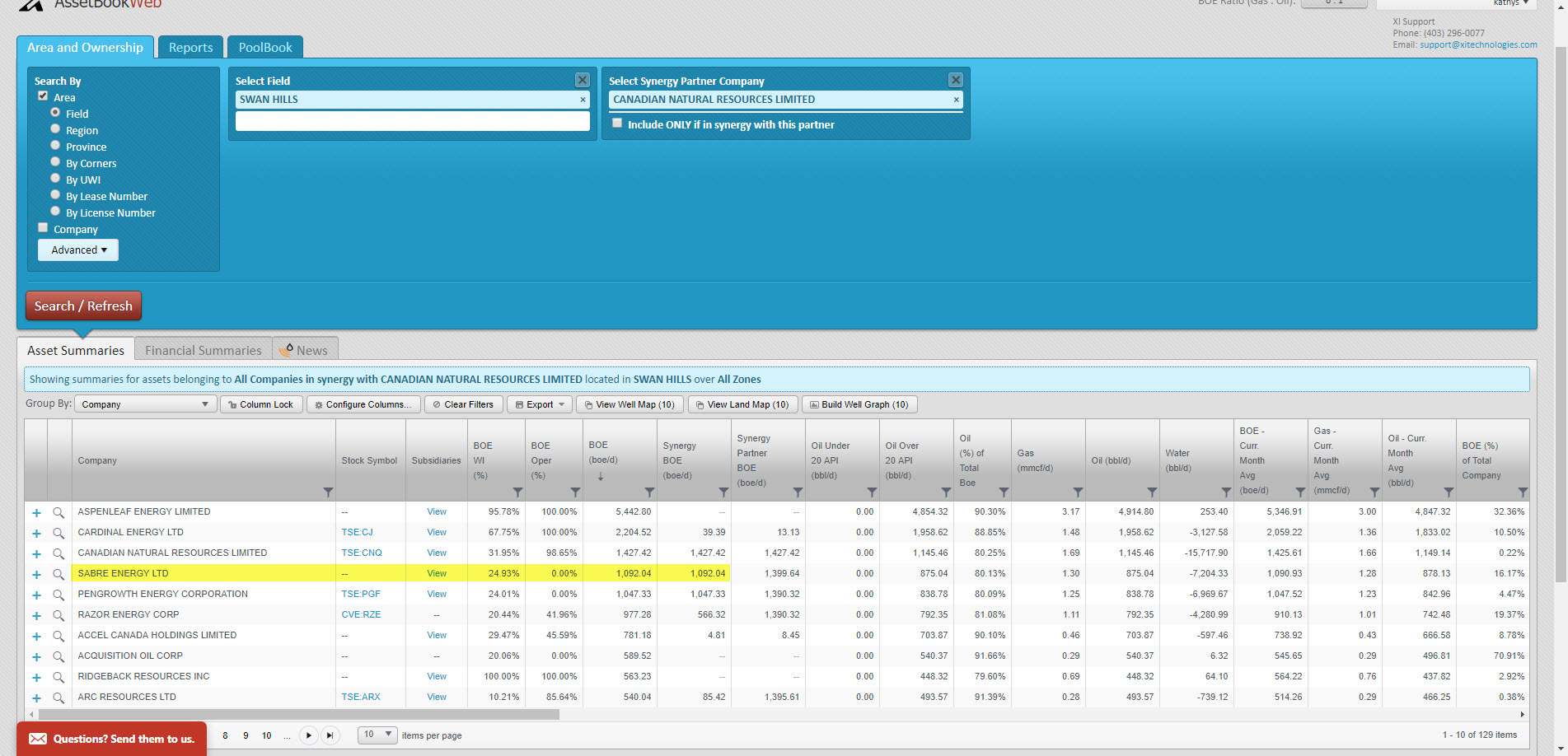

So who might be vulnerable? We can see that one of these companies (a small producer with less than 10,000 boe/d production) derives 16% of their total production from this area, and all of it is in common with Canadian Natural Resources. If CNRL decides to shut in this apparent non-core but operated production, this company is at risk of losing 16% of its company’s production!

Conclusion:

Just because Alberta’s mandatory curtailment exempts the first 10,000 barrels of production doesn’t mean smaller producers aren’t at risk. It’s going to be very important for Companies, Investors and Lending agencies to be able to predict these vulnerable areas and manage relationships with larger producers to avoid surprises.